CORRECTION: A previous version of this press release included amended line-item amounts as total funding for certain projects. This information was inaccurate as the amended line-item amount represents the line-item funding after the amendment included.

BOSTON – On Monday, July 18th, the Massachusetts Legislature unanimously passed a $52.7 billion budget for Fiscal Year 2023 (FY23). The FY23 budget maintains fiscal responsibility and makes precision investments to strengthen the Commonwealth’s economic foundation, protects our most vulnerable neighbors, and support the everyday needs of communities and families Massachusetts.

The final FY23 conference report takes into consideration the historic tax revenue of Fiscal Year 2022 and increases projections by $2.66 billion for a projection of $39.575 billion. This budget also transfers $1.46 billion into the ‘rainy day’ Stabilization Fund, for a projected balance of approximately $7.35 billion at the end of the fiscal year.

Several locally focused amendments were adopted in the FY23 conference report as well. Specifically, State Senator Ed Kennedy secured funding of $50,000 for the Lowell Folk Festival Foundation, and an additional $60,000 for the Kerouac Museum and Performing Arts Center. The town of Tyngsborough will receive an additional $80,000 for town center improvements, while Pepperell will receive an extra $60,000 for technology improvements. Senator Kennedy also managed to secure an additional $1,000,000 for the Greater Lowell Technical Highschool, which serves students from Dracut, Lowell, and Tyngsborough, to upgrade their athletic facilities in compliance with the Americans with Disabilities Act.

“The Fiscal Year 2023 budget is the most robust budget passed by the Legislature yet. It’s targeted investments across education, healthcare, housing, local aid, and economic recovery will ensure the Commonwealth’s future success and improve the quality of life for its current residents,” said State Senator Ed Kennedy (D – Lowell).

Prioritizing funding for education, the Commonwealth’s FY23 budget includes $175 million in a newly created High-Quality Early Education and Care Affordability Trust Fund for utilization in the coming years to support the implementation of the recommendations made by the Early Education and Care Economic Review Commission. Additionally, to ensure resources will be

utilized in the future to support equitable funding for our most vulnerable students, a supplemental payment of $150 million has been included to the Student Opportunity Act (SOA) Investment fund, bringing its balance up to $500 million. This increases the amount of Chapter 70 funding for the City of Lowell to $200,970,019 for fiscal year 2023.

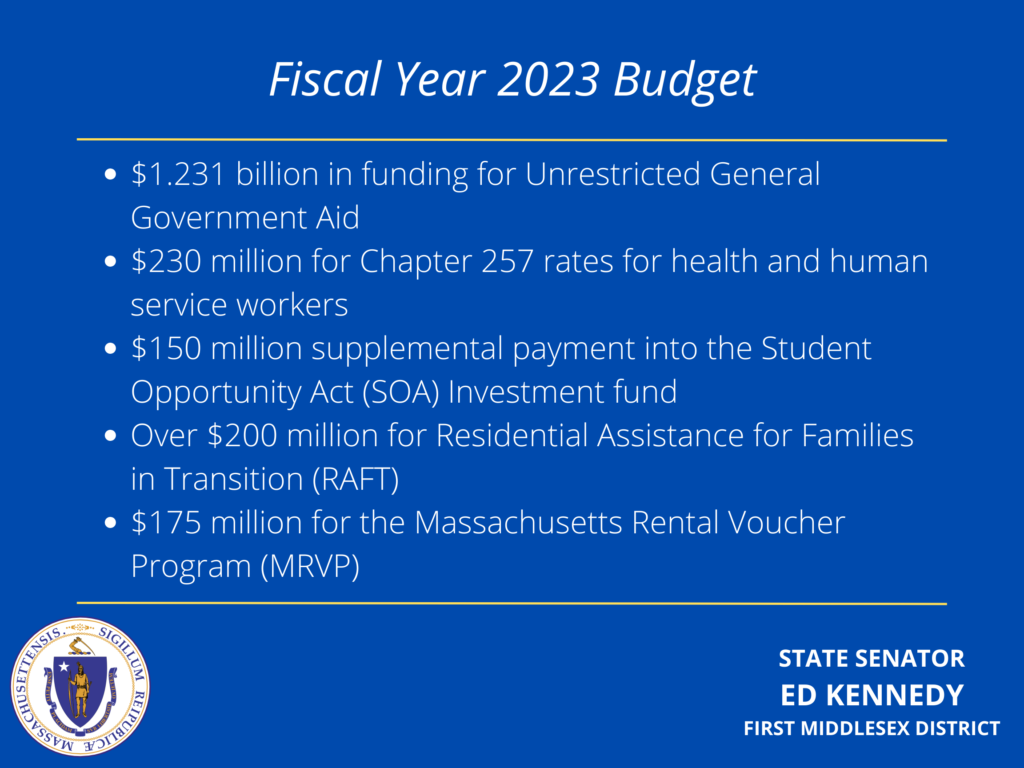

This budget strongly reflects the Legislature’s commitment to the Commonwealth’s municipalities and provides a significant amount of local and regional aid, ensuring communities can provide essential services to the public while rebuilding from a once-in-a-generation pandemic. These investments include $1.231 billion in funding for Unrestricted General Government Aid (UGGA), of which Lowell will receive $29,177,514, an increase of $63 million over FY22, and $45 million in payments in lieu of taxes (PILOT) for state-owned land, an increase of $10 million over FY22, providing supplemental local aid payments to cities and towns working to improve access to essential services and programs.

More than 40 percent of the Commonwealth’s budget is dedicated to healthcare. The Legislature’s FY23 budget maintains assistance for the state’s safety net by funding MassHealth at a total of $19.48 billion, ensuring over 2.1 million people with continued access to comprehensive health care services. Additionally, the FY23 budget invests in the human services workforce who provide services to the state’s most vulnerable residents, including $230 million for Chapter 257 rates for health and human service workers, $40 million to continue higher rate add-ons and ensure a smaller wage cliff between FY22 and FY23 for home health aides and homemakers, and $1 million for the Nursing and Allied Health Workforce Development program. Additional investments include funding for programming such as the Elder Mental Health Outreach Teams, the Safe and Successful Youth Initiative Expansion, nine Elder Supportive Housing Sites, and the SHINE Program.

Building on the foundation of last year’s efforts to tackle deep poverty, the FY23 budget supports working families struggling with the economic toll associated with rising costs and includes a record investment in the annual child’s clothing allowance, providing $400 per child for eligible families to buy clothes for the upcoming school year. The budget also includes a 10 percent increase to Transitional Aid to Families with Dependent Children (TAFDC) and Emergency Aid to the Elderly, Disabled and Children (EAEDC) benefit levels compared to June 2022 to ensure the economic supports necessary to provide stability to families across the state.

The FY23 budget provides resources to help with housing stability to keep individuals and families in their homes, including $219.4 million for Emergency Assistance Family Shelters, more than $200 million for Residential Assistance for Families in Transition (RAFT), $175 million for the Massachusetts Rental Voucher Program (MRVP) and $92 million for assistance to local housing authorities. The budget also upholds the emergency-level maximum amount of rental assistance that a household can receive at $10,000 and requires the Department of Housing and Community Development (DHCD) to study and report on the execution of no-fault evictions between 2019 and 2022.

To boost the Commonwealth’s post-pandemic recovery, the FY23 budget invests more than $100 million to bolster job training programs, help connect unemployed and under-employed

people with higher paying jobs and support career services that help students gain skills to apply for future jobs. The budget includes $20 million for Career Technical Institutes to increase the skilled worker population’s access to career technical training opportunities, a $17 million transfer to the Workforce Competitiveness Trust fund, and $15 million for one-stop career centers to support economic recovery. The budget also includes a $1 million investment in Learn to Earn and $1 million for the 1199 SEIU Training and Upgrading Fund.

The budget also continues the Legislature’s focus on environmental and climate protection by investing $375.2 million for environmental services, which include funding increases for state parks, environmental protection, and fisheries and wildlife. Additional measures include promoting electric vehicles and funding for environmental justice and climate adaptation and preparedness.

Having been passed by the House and Senate, the legislation now goes to Governor Baker for his signature.